i am very proud to introduce this best policy from lic

i am the first person in coimbatore

down load link for power point presentation click this links

your's WELLWISHER

THE PROFESSIONAL INSURANCE & INVESTMENT CONSULTANT

38-A JEEVA STREET,

THE PROFESSIONAL INSURANCE & INVESTMENT CONSULTANT

38-A JEEVA STREET,

VARATHARAJAPURAM MEDU,

UPPILIPALAYAM (POST)

COIMBATORE-641015

MOBILE- 99949 10202, 99439 66337

WEB SITE- www.licnandha.blogspot.com

WEB SITE- www.4myclients.blogspot.

SKYPE ID- call4nanda

LIFE INSURANCE,HEALTH INSURANCE,SHARE TRADING,D-MAT ACCOUNT, MUTUAL FUND,PAN CARD,TAX PLANING ,TAX RETURNS,FINANCIAL PLANING , GENERAL INSURANCE AND MUCH MORE.......

LIC’s SAMRIDHI PLUS

(Plan No.804)

•HIGH RETURNS

•SAFETY OF HIS/HER INVESTMENT

•MUST FULFILL HIS/HER DREAMS

•MUST COVER FOR UNFORTUNATE HAPPENINGS

•TENSION FREE INVESTMENT

•NO TIME FOR MANAGING FUND

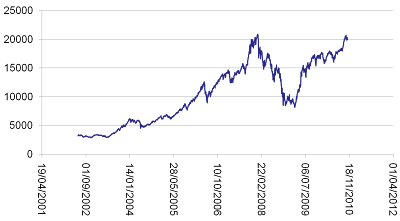

Market Investment Provides

UP AND DOWN

Sensex

movement in last 8 Years

But,An Ordinary investor has

No Time to Manage Investment at Right point

Not able to predict the market correctly

Not able to track the market on daily basis

What is the Solution

ASK US !!!!

LIC’s Samridhi Plus

HIGH RETURNS + 100 % SAFETY

Without compromosing time and Money

MAIN ADVANTAGE OF SAMRUDI +

Investment in Government / Government Guaranteed Securities / Corporate Debt | Short-term investments such as money market instruments | Investment in Listed Equity Shares | Details and objective of the fund for risk /return | |

0% to 100% | 0% to 100% | 0% to 100% | Medium risk |

LIC DOES THE FUND SWITCHING IN SAMRIDHI PLUS

LIC’s SAMRIDHI PLUS

(Plan No.804)

High Returns With Guarantee !!!!!!

Low Charges

Partial Withdrawals

Accident Benefit Rider

Any Person aged 8 to 65 Yrs can Invest

IT Benefits !!!!

Just 3 Months !!!!

Switching taken over by the Most

Trusted Insurer

Assignment/Nomination allowed

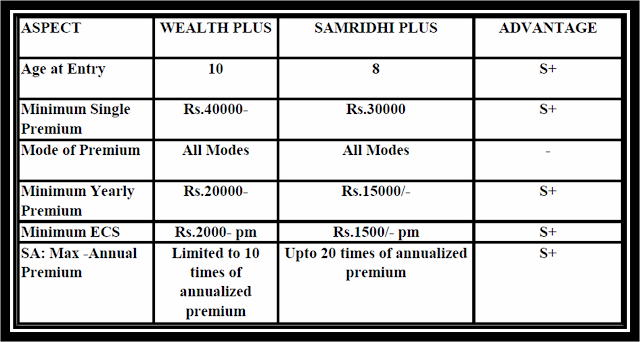

BASIC ELIGIBILITY CONDITION

Who is Eligible: 8 to 65 yrs

Term of Policy: 10 Yrs

Minimum Sum Assured:

5 Yrs Premium Paying Term

For Age less than 45 Yrs: 10 times of Annualized Premium

Ages 45 Yrs and above : 7 times of Annualized Premium

Single Premium

For Age less than 45 Yrs: 1.25 times of Single Premium

Ages 45 Yrs and above : 1.10 times of Single Premium

Minimum Premium: Rs. 30,000 for Single premium

Rs. 15,000 p.a. for Regular Mode

Rs. 1,500 p.m. for monthly (ECS) mode

( Premium in multiples of Rs. 1,000/- for all modes other monthly mode. In Monthly mode it is Rs. 500/-)

Maximum Sum Assured:

5 Yrs Premium Paying Term

For Age less than 45 Yrs : 20 times of Annualized Premium

Ages 45 Yrs and above : 10 times of Annualized Premium

Single Premium

For Age less than 55 Yrs : 5 times of Single Premium

Ages 56 to 65 yrs : 1.25 times of Single Premium

Maximum Premium:

No Limit for Single P.A

Rs. 1,00,000 p.a. for Regular Mode

ADDITIONAL RIDERS

Accident Benefit

Minimum Sum Assured: Rs.25,000

Maximum Sum Assured: Rs.

50,00,000.

Minimum Entry Age: 18 years completed

Maximum Entry Age:60 years nearest birthday

Policy Term: 10 years

Sum Assured shall be available in multiples of Rs. 5,000

BENEFITS AVAILABLE

During the term of policy

Higher of Sum Assured or Policy Holder’s Fund Value

Maturity Benefits at the end of term

Fund value based on highest NAV during first 100 months or NAV as on date of maturity, whichever is higher

GUARANTEED NAV

In this product there is a guarantee of the highest NAV recorded on a daily basis, in the first 100 months of the policy, subject to a minimum of Rs. 10/-. The guarantee will be applicable only for units available in the policyholder’s fund at the end of the policy term. The period to be counted for guarantee of NAV shall be 100 months from the date of commencement of policy.

This Guaranteed NAV will not be applicable for the payment of death claim, surrender and partial withdrawals.

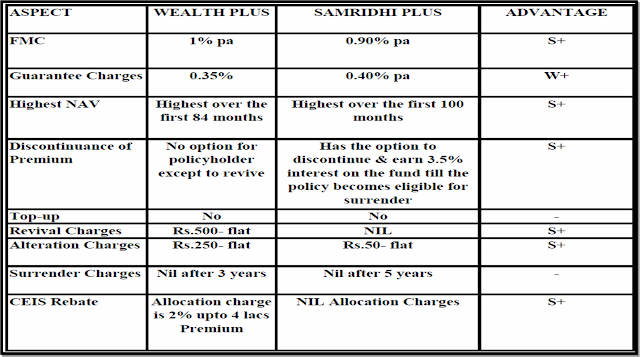

Charges

Allocation Charges

Premium | Allocation Charges |

First Year | 6.00% |

2ND to 5th Year | 4.50% |

Single Premium à 3.3%

Mortality Charges

Based on Sum Assured minus Policy Holder’s Fund Value

Accident Benefit Charges

Rs.0.50 per 1000 Sum Assured

Other Charges

•Policy Administration Charges

Rs. 30/- p.m. for First Year

Rs. 30/- p.m for second year and thereafter escalating @ 3% per year

•Fund Management Charges

@ 0.90% of fund value as at date of computation of NAV

•Guarantee Charges

@ 0.40% of fund value as at date of computation of NAV

•Bid Offer Spread: Nil

•Surrender Charges: Nil

•Service Charges: @ 10.3% on all above charges

WHY Guarantee for

100 Months

100 Months

Any Investment invested for more than 7 years will see a cycle of up and down of the stock market.

The Bond fund will also see full interest cycle.

LIC BIMA PLUS EXPERIENCE

FUND | NAV as on 14/02/2011 | HIGHEST NAV |

SECURED | 31.7010 | 32.3470 |

BALANCED | 40.2476 | 43.8574 |

GROWTH | 57.0698 | 65.6297 |

Short to Medium Term Performance of Index

Triggers for Insurance

SAMRIDHI PLUS – Table 804

Samridhi Plus an excellent plan for all ages…..

Samridhi Plus an excellent plan for all ages…..

8 to 12 years :Because Education is important.

13 to 18 years :To get that head start in life.

19 to 25 years :Save. It’s time to inculcate financial

discipline.

26 to 34 years :You have your loved ones to protect.

35 to 45 years :This plan gets you the best of Stock

Market Benefits through highest NAV.

•46 to 55 years : Because Samridhi Plus is

designed for your prosperity.

•55 to 65 years :The best of Samridhi Plus is for

you - Insurance Protection,

Safety & Growth for your

investments.

Aap Ki Sukh-Samridhi ki

Mangal kamnaon ke liye

LIC's Samridhi Plus.

I AM WAITING FOR

YOUR CALL

TO SERVE YOU

1,ALL DOCUMENTS AND FORMS RECEIVED IN YOUR DOOR STEP

2,RECEIPT GIVEN ON THE SPOT OF YOUR CHEQUE

3,OUR SERVICE TO CONTINUE WHEREVER YOU GO

4,COMPUTERISED DUE REMINDER

5,WE ARE ONE OF THE LEADING INSURANCE & WEALTHMANAGEMENT CONSULTANT IN COIMBATORE

2,RECEIPT GIVEN ON THE SPOT OF YOUR CHEQUE

3,OUR SERVICE TO CONTINUE WHEREVER YOU GO

4,COMPUTERISED DUE REMINDER

5,WE ARE ONE OF THE LEADING INSURANCE & WEALTHMANAGEMENT CONSULTANT IN COIMBATORE

S.V.NANDAGOPAL

your's

WELLWISHER

THE PROFESSIONAL INSURANCE & INVESTMENT CONSULTANT

38-A JEEVA STREET,

WELLWISHER

THE PROFESSIONAL INSURANCE & INVESTMENT CONSULTANT

38-A JEEVA STREET,

VARATHARAJAPURAM MEDU,

UPPILIPALAYAM (POST)

COIMBATORE-641015

MOBILE- 99949 10202, 99439 66337

MOBILE- 99949 10202, 99439 66337

WEB SITE- www.4myclients.blogspot.

SKYPE ID- call4nanda

LIFE INSURANCE,HEALTH INSURANCE,SHARE TRADING,D-MAT ACCOUNT, MUTUAL FUND,PAN CARD,TAX PLANING ,TAX RETURNS,FINANCIAL PLANING , GENERAL INSURANCE AND MUCH MORE.......